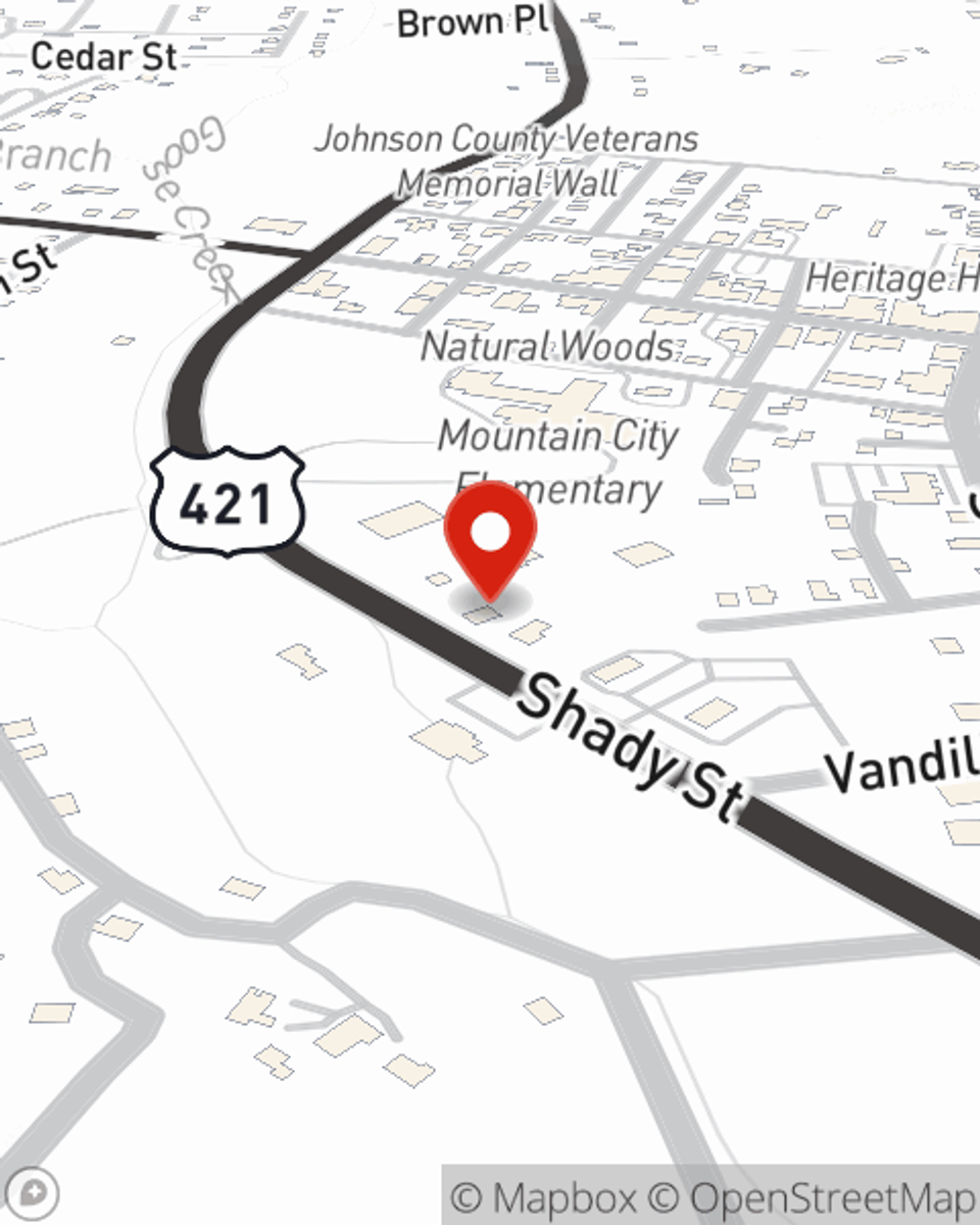

Business Insurance in and around Mountain City

Looking for small business insurance coverage?

This small business insurance is not risky

Coverage With State Farm Can Help Your Small Business.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or loss. And you also want to care for any staff and customers who become injured on your property.

Looking for small business insurance coverage?

This small business insurance is not risky

Protect Your Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Kim Pope is ready to help you prepare for potential mishaps with reliable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Kim Pope can help you file your claim. Keep your business protected and growing strong with State Farm!

Ready to research the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Kim Pope today!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Kim Pope

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?